Explore web search results related to this domain and discover relevant information.

Full Report - Receive the current paper annual or semi-annual report. New rules by the U.S. Securities and Exchange Commission (SEC) permit certain funds to mail you a notice of internet availability of your annual and semi-annual reports (beginning January 1, 2021) instead of a full paper report.

Many investors now opt to go paperless and receive reports electronically, typically by e-mail. If you currently receive shareholder reports electronically, you will continue to receive them this way and no action is required. Click PDF opens in new windowhere to learn how to read a mutual fund report.Receive reports electronically, typically by e-mail.This notice will provide a website address where you can view the full report.If you wish to continue receiving full reports by mail, you must let us know by selecting the Full Report option under Paper Reports here.

Learn what NAV (Net Asset Value) reporting is and why it's a fundamental part of a fund's financial health. Understand its importance for investors, valuation, and regulatory compliance.

To help you avoid such dire consequences, in this article, we will introduce you to NAV reporting, its importance, components, challenges, and best practices. Read on to know more! As the name suggests, net asset value (NAV) is the difference between the total assets and total liabilities. In case of investment funds, these values are adjusted to reflect the income distributions, shareholder activity, and fund management expenses.Just as share price history forms the basis for interpreting returns from stock market investments, NAVs form the basis for interpreting investment fund returns. The three reasons why NAV reporting is a key consideration for fund managers are as follows:NAV reporting is the main disclosure required of investment funds and expected by investors. An investor with a well-diversified portfolio will have active investments in multiple funds and across multiple asset classes. Hence, it is not possible for investors to assess the performance of each investment regularly.NAV forms a crucial element of reports required to be filed with the Securities and Exchange Commission (SEC). Specifically, N-PORT and N-CEN are two forms that most funds need to file. In these forms, funds must disclose the returns and standard deviation of their NAVs in comparison to the index.

Wall Street's top regulator moved on Wednesday to increase transparency for regulators and investors in mutual and exchange-traded funds by requiring them to report portfolio holdings on a monthly basis rather than four times a year.

WASHINGTON, Aug 28 (Reuters) - Wall Street's top regulator moved on Wednesday to increase transparency for regulators and investors in mutual and exchange-traded funds by requiring them to report portfolio holdings on a monthly basis rather than four times a year.Under current reporting rules, registered investment management companies are required to file quarterly reports on portfolio holdings with the commission 60 days after the close of each quarter. But investors only gain access to data that cover the third month of the quarter. With the rule amendments approved on Wednesday, the same funds will be required to file those reports within 30 days of the end of each month, with each such report becoming public after a further 30 days.An earlier swing-pricing proposal aimed to help open-end funds better withstand market stresses, like those seen at the start of the pandemic, by shifting the costs of hasty redemptions to those who cash out rather than those who remain in the fund. The agency disclosed last month that it expects to re-draft the proposal. In advance of the vote, SEC officials told reporters the guidance issued on Wednesday addresses questions such as how frequently open-end funds classify their assets' liquidity, meaning how readily they can be sold for cash, and reviewing required minimums for highly liquid investments.The Investment Company Institute, a trade group, said that increased transparency could expose funds to predatory trading, which can include copying rivals' portfolio decisions.

Find a list of offshore funds that have applied for and been approved as reporting funds.

The list has been updated to include the funds that have entered the Reporting Fund Regime to 1 May 2019. ... The latest version of the list of approved reporting funds has been added.The list has been updated to include the funds that have entered the Reporting Fund Regime as at 1 July 2015. ... Reporting Fund Regime as at 4 June 2015.This is a list of offshore funds that have successfully applied to HMRC for reporting fund status.The list of reporting funds has been updated.

The agreement, expected to be filed into legislative text on Wednesday, aims to shore up the fund that has been at risk of depletion following devastating January wildfires in the Los Angeles area. According to a report from Bloomberg, citing people familiar with the negotiations, the plan ...

The agreement, expected to be filed into legislative text on Wednesday, aims to shore up the fund that has been at risk of depletion following devastating January wildfires in the Los Angeles area. According to a report from Bloomberg, citing people familiar with the negotiations, the plan will split funding equally between ratepayers and utility shareholders.California utility stocks rise after report on $18B wildfire fund boostInvesting.com -- PG&E Corporation (NYSE:PCG) stock rose 4%, Edison International (NYSE:EIX) gained 1%, and Sempra (NYSE:SRE) climbed 1.5% after California lawmakers reached an initial agreement to boost the state’s wildfire utility fund by approximately $18 billion.The January wildfires that ravaged parts of the Los Angeles area prompted concerns about the sustainability of the California Wildfire Fund, which was established to help utilities manage wildfire-related costs.

A semi-annual report must also be provided six months into the fiscal year. The Securities and Exchange Commission (SEC) is the governing federal agency that determines fund reporting requirements across mutual funds and ETFs. While each fund has some flexibility in report design, the new Tailored ...

A semi-annual report must also be provided six months into the fiscal year. The Securities and Exchange Commission (SEC) is the governing federal agency that determines fund reporting requirements across mutual funds and ETFs. While each fund has some flexibility in report design, the new Tailored Shareholder Report rule specifies required content in a required order.Reports must also be brief and written in plain English. The fund report is one way to keep up with investment performance, fees, holdings, financial conditions and material changes. Reports are created twice per year.Typivally, fund’s website provide the latest performance information. It is very common for companies to issue shares with different classes. Be sure you understand differences in fees and expenses for share classes. The Tailored Shareholder Report you receive will be for the share class you own.Expenses may include management fees, distribution & service (also called 12b-1) fees, transfer agent fees, and administrative costs among others. The combined fees are the best foundation for comparison—those are represented in a fund’s total operating expense ratio or percentage. The new summary report also provides this amount in dollars based on a $1,000 investment.

The company is also developing a long-acting injectable formulation of RAP-219 and is evaluating the drug in a Phase 2 trial for bipolar mania, with results expected in the first half of 2027. With a current ratio of 22.75, Rapport maintains strong liquidity to fund its development pipeline, ...

The company is also developing a long-acting injectable formulation of RAP-219 and is evaluating the drug in a Phase 2 trial for bipolar mania, with results expected in the first half of 2027. With a current ratio of 22.75, Rapport maintains strong liquidity to fund its development pipeline, though InvestingPro analysis indicates the stock is currently trading slightly above its Fair Value.RAP-219 was generally well-tolerated, with most adverse events being mild (78.5%) or moderate (21.5%). The most common side effects included dizziness (26.7%), headache (16.7%), and fatigue (13.3%). No serious adverse events were reported during the treatment period, and 10% of patients discontinued due to adverse events.Rapport plans to advance RAP-219 into two Phase 3 pivotal trials in the third quarter of 2026, following an end-of-Phase 2 meeting with the FDA expected in the fourth quarter of 2025. While the company’s next earnings report is due on November 6, InvestingPro analysis shows analyst price targets ranging from $28 to $42, suggesting significant potential upside despite current unprofitability.Rapport’s epilepsy drug shows 78% seizure reduction in phase 2 trial

WASHINGTON, D.C. — Today, the House Select Committee on China released a groundbreaking investigative report revealing that the Biden-era Defense Department and longtime career officials have allowed extensive research to be conducted with CCP-backed defense entities while funded by U.S.

More than 1,400 research publications have been identified involving DOD-funded projects with Chinese partners—totaling more than $2.5 billion in taxpayer funding. Approximately 800 of the publications—over half— involved direct collaboration with Chinese defense entities. Several case studies in the report point to large national security risks.This report follows the September 2024 investigation by Select Committee Chairman John Moolenaar (R-MI) and former House Education and Workforce Committee Chairwoman Virginia Foxx (R-NC) which uncovered that hundreds of millions of dollars in U.S. federal research funding over the last decade has contributed to China’s technological advancements and military modernization.DOD R&E does not currently prohibit research relationships on fundamental research with entities DOD has designated as national security threats under the DOD 1260H List—rendering the list functionally meaningless and undermining its own research security framework. DOD does not currently conduct post-award compliance or monitoring of grants, including in cases where risk mitigation measures were required. · The Select Committee's new report makes it clear: there is no justification for U.S.taxpayer-funded research to be conducted with entities documented to have facilitated human rights abuses or support China’s mass surveillance apparatus. · Read the new report here.

Norway's sovereign wealth fund on Thursday reported a first-quarter loss of 415 billion kroner ($40 billion), citing weakness in the tech sector.

Norges Bank Investment Management — the largest sovereign wealth fund in the world — on Thursday reported a first-quarter loss of 415 billion kroner ($40 billion), citing weakness in the tech sector.The fund's value hit 18.53 trillion kroner at the end of March, with 70% of its investment placed in equities — an asset class for which it recorded a loss of 1.6%.The fund's market value decreased by 1.215 trillion kroner through the first quarter, largely due to adverse currency movements.Aside from equities, fixed incomes represents 27.7% of the fund holdings and returned 1.6% over the first quarter.

Commonwealth Funds believes investors should track mutual fund investment performance by reviewing the semi-annual and annual fund reports. These are instrumental to measure their value.

Every report details the performance of each fund, as well as the portfolio composition and its percentage towards the total investment, so you know at all times what you’re investing in. The report goes on to list the schedule of investments and identifies financial highlights, such as net value assets from the beginning to end of a period.Click a year to open and view a report.

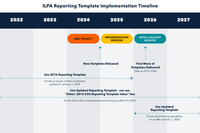

The updated ILPA Reporting Template is intended to replace the 2016 ILPA Reporting Template on a go-forward basis for Funds still in their investment period during Q1 2026 or for Funds commencing operations on or after January 1, 2026.

The ILPA Reporting Template, updated in 2025, is intended to replace this 2016 ILPA Reporting Template on a go-forward basis for Funds still in their investment period during Q1 2026 or for Funds commencing operations on or after January 1, 2026.GPs may continue to provide the 2016 Reporting Template, available below, for Funds that are no longer in their investment period as of Q1 2026.ILPA's reporting template encourages transparency and alignment between LPs & GPs, addressing shared reporting and compliance challenges in private equity.The ILPA Reporting Template promotes more uniform reporting practices in the private equity industry related to fees, expenses and carried interest, representing a step forward in enhanced transparency in these areas.

Morningstar’s latest mutual fund research and analysis. Get an inside look at the mutual fund industry and your favorite funds through the eyes of our analysts.

We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes.Explaining the gap between bond funds’ investor returns and total returns.These bond ETFs and mutual funds earn Morningstar’s top rating.How the funds stacked up, and what set Pimco apart.

Learn how to find and use our fund analyst reports.

Price: Our assessment of a fund's expenses relative ot its peer group and sales channel, as well as of a fund's costs in the context of its strategy. ... Understand a company's strengths with our company reports.Access, download, or print Investor's one-page PDF investment detail reports. ... Morningstar's Approach to Investing Getting Started Manage Account Payment Information Email Newsletters Portfolio Watchlists Screener Stocks Funds Reports Markets Notifications Premium and Portfolio Manager WebinarsEvery fund quote page (for mutual funds or ETFs) contains a fund analyst report, or a series of evaluations that are visible exclusively to Morningstar Investor subscribers.People: Our evaluation of the fund management team’s experience and ability.

Please visit our classification ... and mutual funds. To request permission to use or reproduce ICI material, please use the permission request form. Interested in nonmember access to ICI’s statistical research? Subscribe to receive selected reports on this website and ...

Please visit our classification definitions page for detailed information on ICI’s classifications for closed-end funds, exchange-traded funds, and mutual funds. To request permission to use or reproduce ICI material, please use the permission request form. Interested in nonmember access to ICI’s statistical research? Subscribe to receive selected reports on this website and by electronic delivery.This page contains a list of Statistical Publications available on this site.

Morningstar is an investment research company offering mutual fund, ETF, and stock analysis, ratings, and data, and portfolio tools. Discover actionable insights today.

These dividend ETFs and mutual funds earn high ratings from Morningstar.We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes.

The Income-Covered Closed-End Fund Report screens for CEFs with distribution coverage exceeding 100%, indicating lower risk of distribution cuts.

The "Income-Covered Closed-End Fund Report" screens for CEFs with distribution coverage exceeding 100%, indicating lower risk of distribution cuts.The report ranks funds by widest discounts, best z-scores, highest yields, and best combinations of yield, discount, and z-score for further research.(This was formerly the "Quality" CEF Report, now renamed to better reflect the focus on distribution coverage) Quantitative screens help to rapidly narrow down attractive candidates from the database of ~400 closed-end funds forIn the members section, we provide specific commentary on the top ranked funds and discuss whether they deserve a place in your income portfolio. At the CEF/ETF Income Laboratory, we manage closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you.

View the Year 3: Future Fund Evaluation Report 2025.

RSM UK Consulting LLP has been commissioned by the British Business Bank to undertake the three-year impact evaluation of the Future Fund (a UK Government scheme that was set up to support potentially viable UK-based companies that were facing difficulties in raising equity finance due to the Coronavirus (Covid-19) pandemic). This Year 3 report is the last of three reports to be covered in the evaluation of the Future Fund, with the first report having been published in November 2022 and the second report having been published in October 2023.Future Fund evaluation report 2025Download report (.pdf, 2.55mb)

Enter abstracts or other scientific ... from RePORTER or program officials associated with those projects. These matches are based on the terms and concepts used in the submitted text. Matchmaker summarizes the projects by the program official, institute or center, review panel, and activity code. ... NIH Awards by Location - Explore year-by-year NIH funding by institution, ...

Enter abstracts or other scientific text and Matchmaker will return lists of similar projects from RePORTER or program officials associated with those projects. These matches are based on the terms and concepts used in the submitted text. Matchmaker summarizes the projects by the program official, institute or center, review panel, and activity code. ... NIH Awards by Location - Explore year-by-year NIH funding by institution, state, congressional district, and more!Subscribe to the NIH RePORT ListServ to stay up to date on changes to these sites. Implementation of New Initiatives and Policies Page Now Available - Mar 2025 · How Can You Effectively Prepare NIH Research Project Grant Applications for Due Dates in 2025 and Beyond? - Mar 2025 · Find NIH Funding Information More Quickly and Easily with RCDC’s New Look and Feel - Mar 2025The RePORT Expenditures and Results (RePORTER) module allows users to search a repository of NIH-funded research projects and access publications and patents resulting from NIH funding.Categorical Spending displays the annual support level for various research, condition, and disease categories based on grants, contracts, and other funding mechanisms used across the National Institutes of Health (NIH), as well as disease burden data. The NIH does not expressly budget by category.

When the program agencies decide ... from the funds' investment balances and transfers the proceeds, including interest earned on the investments, to the program accounts for payment by the agency. The Bureau provides monthly and other periodic reporting to each fund's program ...

When the program agencies decide that monies are needed, Fiscal Service cashes securities from the funds' investment balances and transfers the proceeds, including interest earned on the investments, to the program accounts for payment by the agency. The Bureau provides monthly and other periodic reporting to each fund's program agency.They receive Social Security, Medicare, excise, and employment taxes---all collected by Treasury---and premiums, fines, penalties, and other designated monies collected by the agencies that administer the programs for which these trust funds exist.The invested assets are kept in the trust fund account until money is needed by the specific Federal Program agency to fund program activity, such as Social Security and unemployment benefit payments, or highway funding.The Secretary of the U.S. Treasury is designated by law as the managing trustee for 18 of the approximately 250 federal investment funds.

Investors should check these important items in their semiannual mutual fund shareholder reports.

For starters, just because you keep hearing about how strong the stock market has been since the November election, your fund might not have followed suit. Most references to the market's gains are based on the major stock indexes. There's a treasure trove of information in these reports.So depending on the specific investments, a fund's performance could vary wildly from that of the broader market. And even though the data in the report is typically a couple of months old, it's worth checking to see if the fund performed as you expected and to see how it compared to whichever index it uses as a benchmark.The data shows the dollar cost associated with a hypothetical $1,000 invested in the fund during the six months covered in the report. This number excludes transaction-related expenses like a sales charge when you buy the fund (called a front-end load) or a redemption fee (back-end load).However, it lets you figure out exactly how much the fund is costing you versus seeing a complicated explanation of fees in a prospectus. Say the chart shows that a $1,000 investment paid $1.15 in expenses during the six months covered. If you have $100,000 invested, it cost you 100 times that amount or $115. Also, semiannual reports are required to include the cost of a hypothetical $1,000 invested at a return rate of 5 percent.