7 Ways Fund Reporting Technology Revolutionizes Investment Management

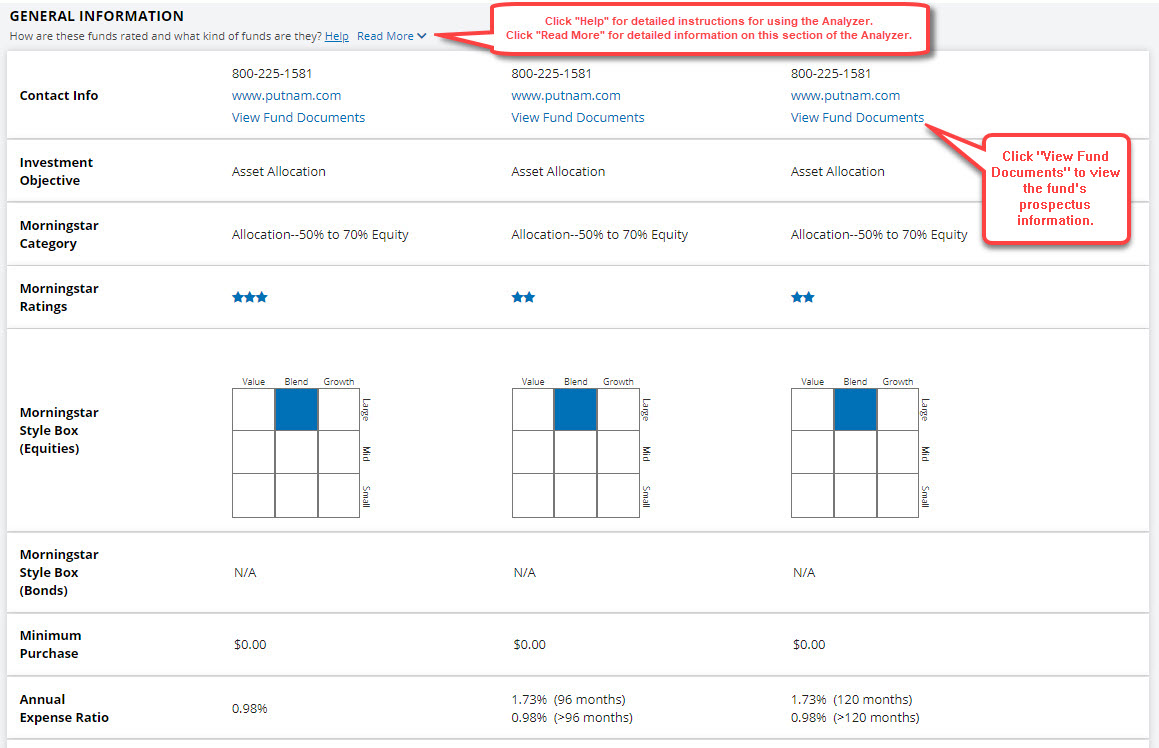

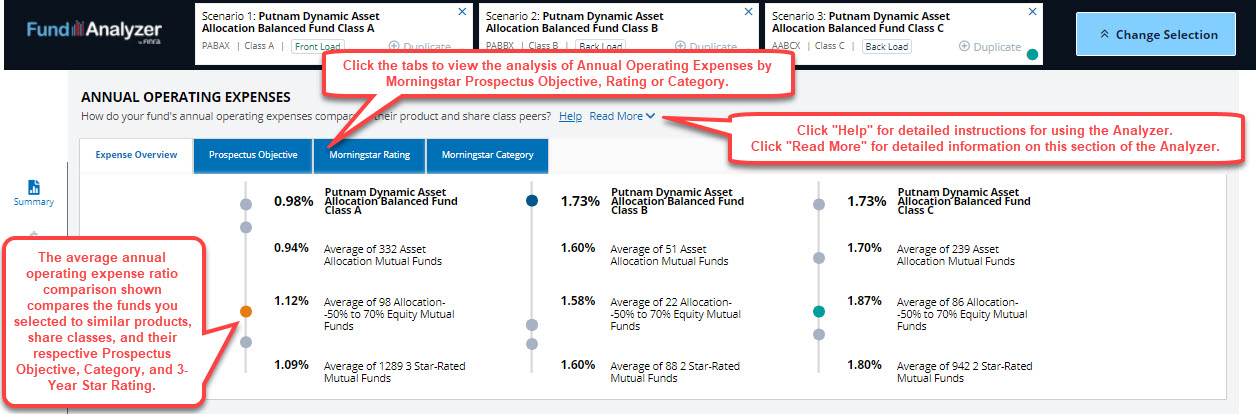

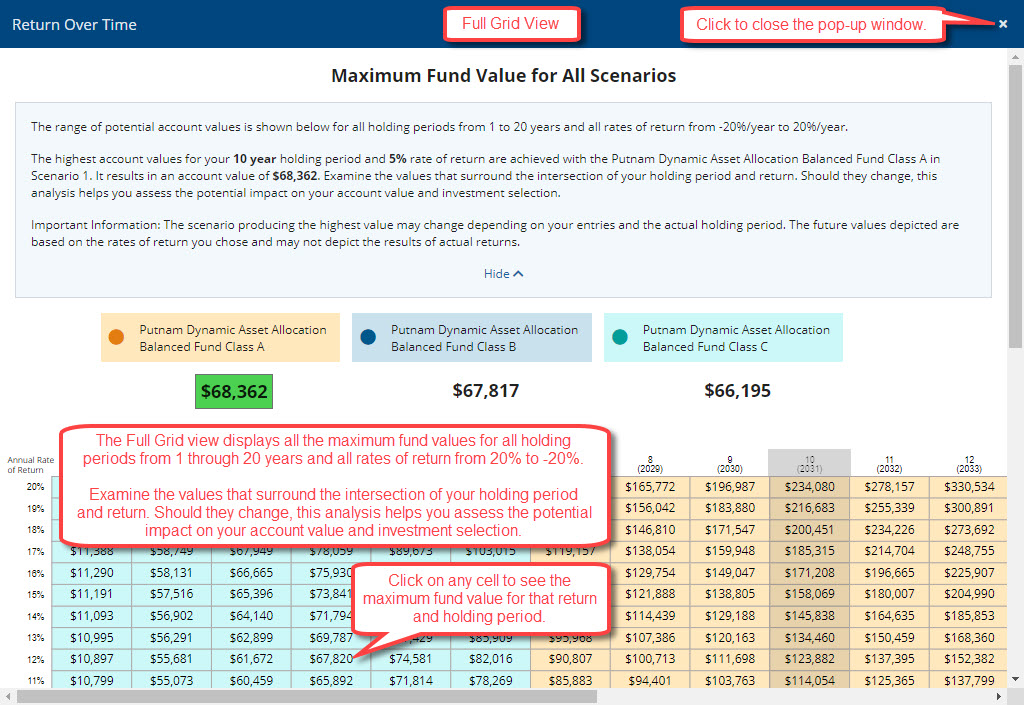

1. Enhanced Decision-Making Speed: Modern reporting platforms reduce data processing time from hours to minutes, enabling faster investment decisions and market response.

2. Risk Management Optimization: Advanced analytics identify potential risks before they impact portfolio performance, allowing proactive risk mitigation strategies.

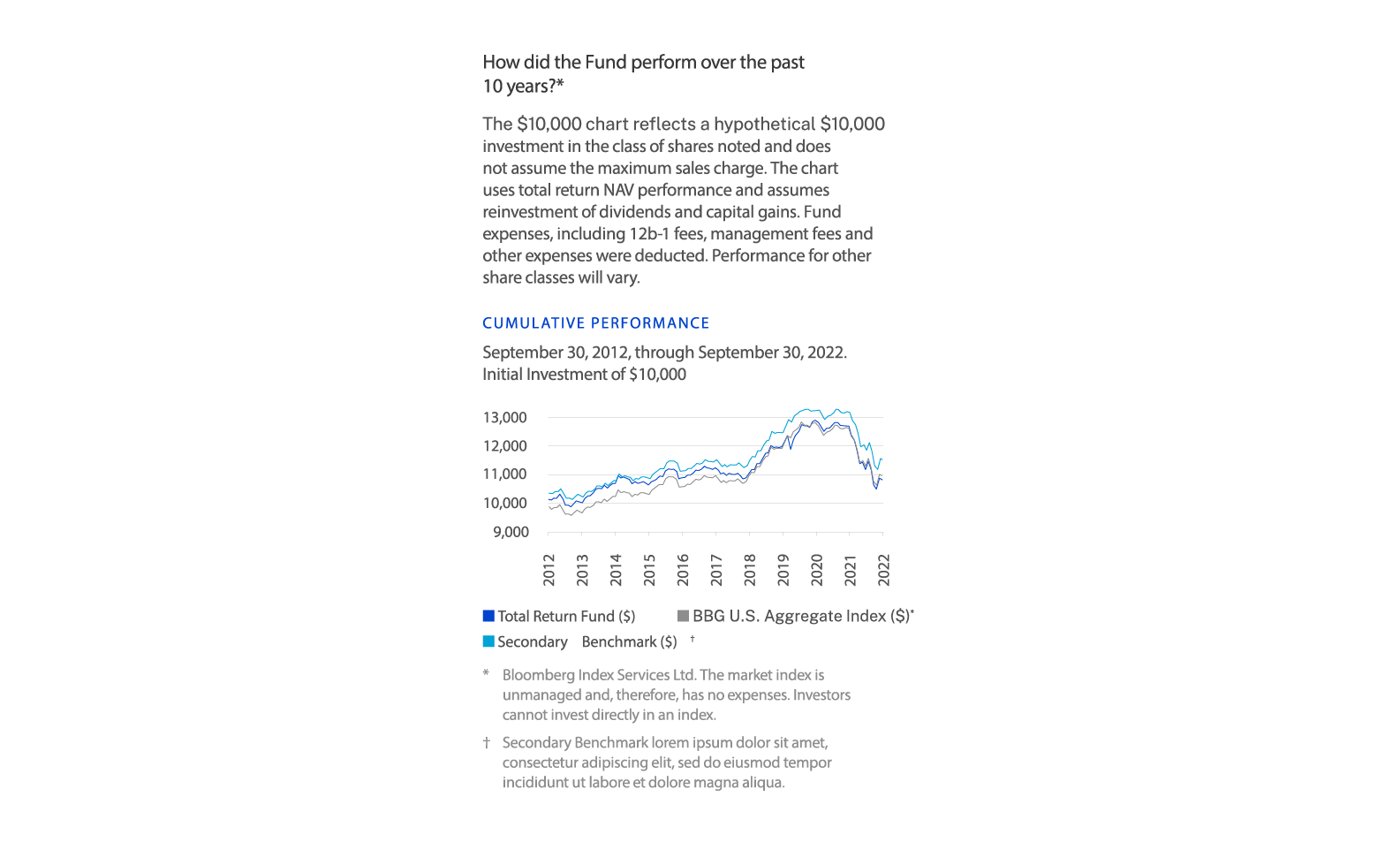

3. Client Communication Excellence: Professional-grade reports and presentations that clearly communicate fund performance to investors and stakeholders.

4. Operational Efficiency Gains: Automated workflows eliminate manual data entry and reduce operational costs by up to 40% while improving accuracy.

5. Regulatory Compliance Assurance: Built-in compliance monitoring ensures adherence to evolving regulations and reduces regulatory risk exposure.

6. Performance Attribution Analysis: Detailed breakdowns of return sources help identify successful strategies and areas for improvement.

7. Scalable Infrastructure: Cloud-based solutions that grow with your business, supporting everything from boutique firms to large institutional investors.